Who Is Paying for the 2025 U.S. Tariffs?

谁在为 2025 年美国关税买单?

原文 / Source: https://libertystreeteconomics.newyorkfed.org/2026/02/who-is-paying-for-the-2025-u-s-tariffs/

说明:本文为全文翻译(中英对照,段落交替)

摘要 / Summary

EN: Over the course of 2025, the average tariff rate on U.S. imports increased from 2.6 to 13 percent. Using import data through November 2025, the authors ask how much of the tariffs were paid by the U.S. and find that nearly 90 percent of the tariffs’ economic burden fell on U.S. firms and consumers.

中: 2025 年,美国进口的平均关税税率从 2.6% 上升到 13%。作者使用截至 2025 年 11 月的进口数据,评估关税成本最终由谁承担,并发现关税的经济负担接近 90% 落在美国企业与消费者身上。

2025 年关税 / 2025 Tariffs

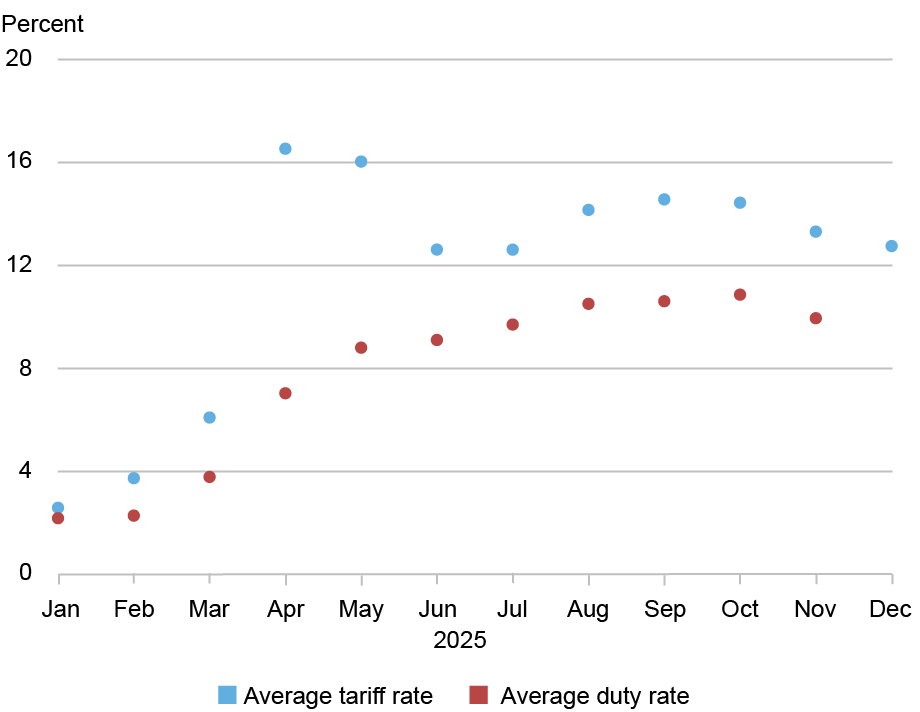

EN: The chart below plots U.S. import tariffs by month in 2025. Blue dots show the average statutory tariff rate (weighted by 2024 annual import values). Red dots show the average duty rate by month (total duties collected divided by total import value).

中: 下图按月展示 2025 年美国进口关税。蓝点为平均法定关税税率(以 2024 年全年进口额为权重);红点为平均实际税负(当月征收关税总额 ÷ 当月进口总额)。

EN: The average tariff rate was very low at the beginning of the year (2.6 percent). It then spiked in April and May when tariffs on Chinese goods were raised by 125 percentage points, before being reversed by 115 percentage points in mid-May. By the end of the year, the average tariff rate was 13 percent.

中: 年初平均关税税率很低(2.6%)。在 4 月与 5 月,由于对中国商品关税上调 125 个百分点,税率显著飙升;随后在 5 月中旬又回撤 115 个百分点。到年底,平均关税税率达到 13%。

EN: The average duty rate is lower than the statutory tariff rate because of many exemptions. For example, while the U.S. levies a 35 percent tariff on Canadian imports, 83 percent of those imports are exempt from duties under the USMCA.

中: 平均实际税负低于法定税率,主要因为存在大量豁免。例如,虽然美国对加拿大进口征收 35% 关税,但在《美墨加协定(USMCA)》下,加拿大进口中约 83% 可免于缴税。

EN: A second reason is that importers shift away from high-tariff goods. The difference between the statutory rate and the duty rate peaked in April and May as importers shifted away from Chinese imports to avoid the higher tariffs.

中: 第二个原因是进口商会从高关税商品转向替代来源/替代品。4—5 月期间法定税率与实际税负的差距最大,反映了进口商为了躲避对中国商品的高关税而进行的转移。

供应链如何变化 / Supply Chains Shift

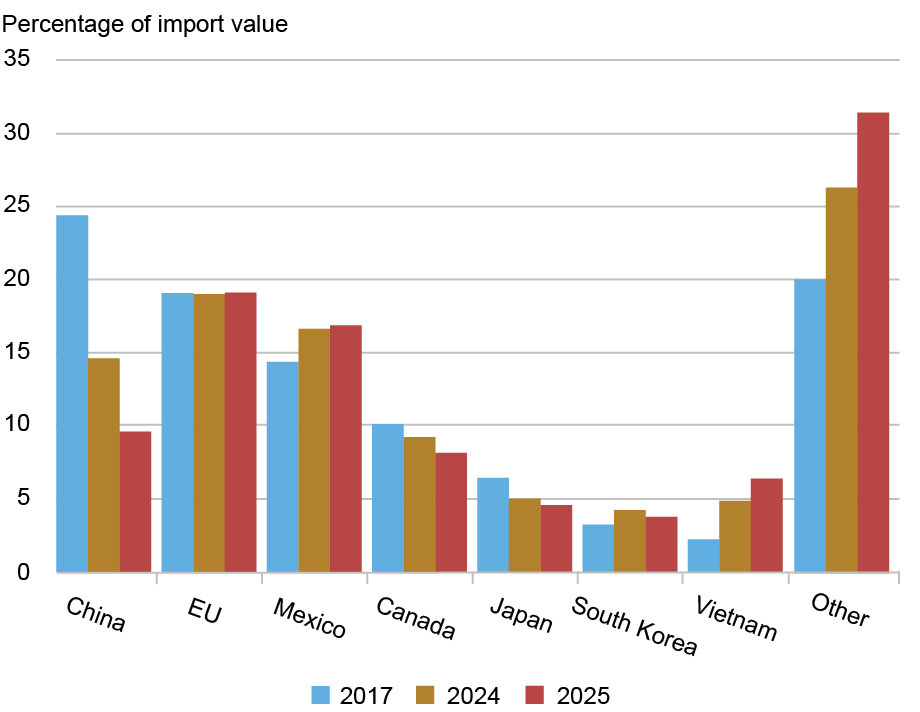

EN: The next chart shows import shares by country (or region) for 2017, 2024, and 2025, ordered by 2017 import shares. Seven exporters accounted for about 80 percent of U.S. imports in 2017, with China near 25 percent.

中: 下图展示 2017、2024 与 2025 年(2025 为 1—11 月)按国家/地区划分的进口份额,并按 2017 年份额排序。2017 年这七个出口方约占美国进口的 80%,其中中国接近 25%。

EN: After tariffs on Chinese goods rose around 9 percentage points in 2018-2019, China’s share fell to about 15 percent by 2024. Strikingly, in the first eleven months of 2025, China’s share fell by another 5 percentage points, below 10 percent. Mexico and Vietnam gained the most.

中: 2018—2019 年对中国商品关税上升约 9 个百分点后,到 2024 年中国份额降至约 15%。更显著的是,2025 年前 11 个月中国份额又下降约 5 个百分点,跌破 10%;墨西哥和越南的份额提升最多。

EN: China faces the highest tariffs among the countries/regions shown.

中: 在图中所列国家/地区里,中国面临的关税最高。

谁承担关税成本?/ Who Bears the Cost of Tariffs?

EN: “Tariff incidence” describes how the costs of a tariff are split between foreign exporters and domestic importers. Importers pay the duty, but the economic burden can shift to exporters if they lower export prices.

中: “关税归宿(tariff incidence)”指关税成本在外国出口商与国内进口商之间如何分摊。进口商在海关缴税,但如果出口商为了保住市场份额而降价,经济负担就可能部分转移到出口商。

EN: Example: if exporters charge $100 and a 25% tariff is imposed, and the foreign price stays $100, the duty is $25 and the import price rises to $125. Incidence falls entirely on the importer (100% pass-through).

中: 例子:出口商报价 100 美元,进口国加征 25% 关税。若出口价格不变,税额为 25 美元,进口到岸价升至 125 美元,此时关税负担完全由进口方承担(价格对关税 100% 传导)。

EN: If exporters cut their price to $80 (= $100/1.25), the importer still pays $100 inclusive of tariff (with $20 duty). Then incidence falls entirely on exporters (0% pass-through).

中: 若出口商把不含税价格降到 80 美元(=100/1.25),则含税进口价仍为 100 美元(其中 20 美元为关税),此时负担完全由出口商承担(对进口价 0% 传导)。

EN: In an intermediate case, if the exporter lowers the price to $96, the tariff-inclusive price becomes $120. The exporter bears $4 and the importer bears $20; importer incidence is 83% ($20/$24).

中: 中间情形:出口商降到 96 美元,含税价变为 120 美元。出口商承担 4 美元、进口商承担 20 美元;进口商承担比例为 83%(20/24)。

实证结果 / Empirical Results

EN: The authors follow the approach used in their earlier study on the 2018-2019 tariffs: regress 12‑month percent changes in foreign export prices on 12‑month percent changes in tariffs, controlling for product and country-date effects to isolate the tariff’s differential impact.

中: 作者沿用其对 2018—2019 年关税的研究方法:用“外国出口价格(不含关税的进口单价的代理)”的 12 个月变动回归“关税(1+税率)的 12 个月变动”,并加入产品固定效应与国家×日期固定效应,以识别关税的差异化影响。

EN: Results indicate that the bulk of incidence continues to fall on U.S. firms and consumers, consistent with other studies reporting high pass-through of tariffs into U.S. import prices.

中: 结果显示关税负担的大头仍落在美国企业与消费者身上,这与其他研究发现的“关税对美国进口价格高度传导”一致。

关税归宿估计(表)/ Tariff Incidence (Table)

| 2025 时段(平均) / Period | 外国出口商承担(%) / Foreign exporters | 美国进口商承担(%) / U.S. importers |

|---|---|---|

| 1–8 月 / Jan–Aug | 6 | 94 |

| 9–10 月 / Sep–Oct | 8 | 92 |

| 11 月 / Nov | 14 | 86 |

EN: In the first eight months, 94% of incidence was borne by the U.S.—a 10% tariff was associated with only a 0.6 percentage point decline in foreign export prices.

中: 在前 8 个月,美国承担比例为 94%,意味着 10% 的关税仅对应外国出口价下降 0.6 个百分点。

EN: Pass-through declined later in the year. By November, a 10% tariff was associated with a 1.4% decline in foreign export prices, implying 86% pass-through.

中: 年末阶段传导有所下降。到 11 月,10% 关税与外国出口价下降 1.4% 相关,对应约 86% 的传导。

EN: With an average tariff of 13% in December, the results imply import prices for goods subject to the average tariff rose about 11% (= 13 × 0.86) more than goods not subject to tariffs.

中: 12 月平均关税约 13% 时,结果暗示:受平均关税影响的商品,其进口价格相对未受关税影响的商品高出约 11%(=13×0.86)。

结论 / Conclusion

EN: U.S. firms and consumers continued to bear the bulk of the economic burden of the high tariffs imposed in 2025.

中: 总体而言,2025 年高关税的经济负担仍主要由美国企业与消费者承担。

作者 / Authors

EN: Mary Amiti; Chris Flanagan; Sebastian Heise; David E. Weinstein.

中: Mary Amiti、Chris Flanagan、Sebastian Heise、David E. Weinstein。

引用 / Citation

EN: Amiti, Flanagan, Heise, and Weinstein (2026), “Who Is Paying for the 2025 U.S. Tariffs?,” Liberty Street Economics, Federal Reserve Bank of New York, Feb 12, 2026. https://doi.org/10.59576/lse.20260212

中: Amiti 等(2026),《谁在为 2025 年美国关税买单?》,纽约联储 Liberty Street Economics,2026-02-12。https://doi.org/10.59576/lse.20260212

Disclaimer(原文免责声明): The views expressed are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System.